Price Waterhouse Coopers (PWC) publishes an annual overview of the African hotel industry. The Hospitality Outlook PWC report includes a forecast for the next few years, while the report is mostly based on higher-end hotel performance, we found a few interesting points you might find relevant.

Current hospitality trends in South Africa:

You won’t be surprised to hear that PWC found that average daily rates are under pressure. Online travel sites make bargain hunting easy, which means that everyone has adjusted their rates down.

We find that corporates are increasingly booking NightsBridge properties online. The PWC report also mentions noticeable growth in the MICE (Meetings, Incentives, Conferences and Exhibitions) market.

Mid-market hotels (and of course independent properties, like yours) are popular with millennials and will benefit from the growth in domestic and adventure tourism.

For guest houses and B&Bs, Airbnb offers an additional distribution opportunity. PWC doesn’t think that large hotels have to worry about competition from Airbnb.

Domestic tourism on the rise:

The Hospitality Outlook Report found that local travel became more popular during 2018 because of cheaper airfares and more competition between airlines. A study showed that 50% of South Africans would rather spend money on a memorable experience than a shopping spree. More visitors were seen at the V&A Waterfront, Cape Point Reserve and Table Mountain in 2018 compared to 2017, at the height of the Western Cape drought.

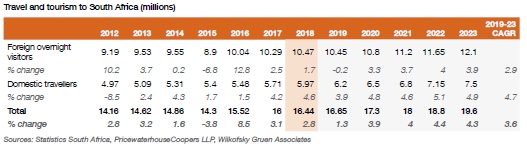

100 000 more visitor activities were documented to safari and historic venues at Kruger National Park, Apartheid Museum, Robben Island, Mandela House and Constitution Hill. A brighter economy will see a rise in domestic travel from 5.97 million travellers in 2018, to about 7.50 million in 2023.

100 000 more visitor activities were documented to safari and historic venues at Kruger National Park, Apartheid Museum, Robben Island, Mandela House and Constitution Hill. A brighter economy will see a rise in domestic travel from 5.97 million travellers in 2018, to about 7.50 million in 2023.

The role of Airbnb:

Growth in Airbnb’s guest activity shows an R8.7bn impact on our economy between June 2017 and May 2018, with support of over 22,000 jobs.

Rentals in Cape Town alone went up from 10,000 in 2015 to 40,000 in 2018. PWC’s Hospitality Outlook Report says even though guest houses use Airbnb as another distribution channel to increase occupancy, the Cape Town hotel industry does not suffer as a result.

Demand for Airbnb rooms is higher during peak periods because this is when hotels are full. Visitors look for added value like swimming pools, spas, and restaurants. It’s a good idea to add all the amenities close to you, on your own website.

Youth travel shows promise of predicted growth to benefit the mid to lower market.

For more statistics, take look at the full report: https://www.pwc.co.za/en/publications/hospitality-outlook.html.

READ: The trends predicted to shape African Tourism beyond 2022

Images: Main picture: Montecasino – Image courtesy of Tsogo Sun Other: PWC Hospitality Outlook report 2019-2023.