At this year’s Africa Travel Week, Theresa Emerick, CEO of NightsBridge, took the stage to demystify the often-complex world of payment solutions in the tourism industry. Her talk, humorously dubbed “The Payments Puzzle,” wasn’t just about tooting NightsBridge’s horn. It was packed with insights meant to help hospitality owners navigate the tricky terrain of modern payment systems. Here’s a breakdown of her main points and why they’re crucial for anyone in the hospitality game.

Understanding the Need for Payment Integration.

Theresa kicked off by explaining how NightsBridge evolved into what she called an “accidental fintech” company. Initially, they just wanted to help small lodging providers manage online bookings, but quickly realised the massive hurdles these businesses faced around payments—especially the hefty fees of setting up merchant accounts. This led them to create solutions that integrate payment processing directly with property management systems.

Why it’s important: Integrated systems simplify everything from booking to checkout. They ensure payments are secure and transactions are smooth, which not only saves time but also boosts customer confidence. Think of it as upgrading from a cash-only market stall to a full-fledged shop with a modern cash register that accepts all cards and online payments.

Embracing Mobile and Contactless Payments.

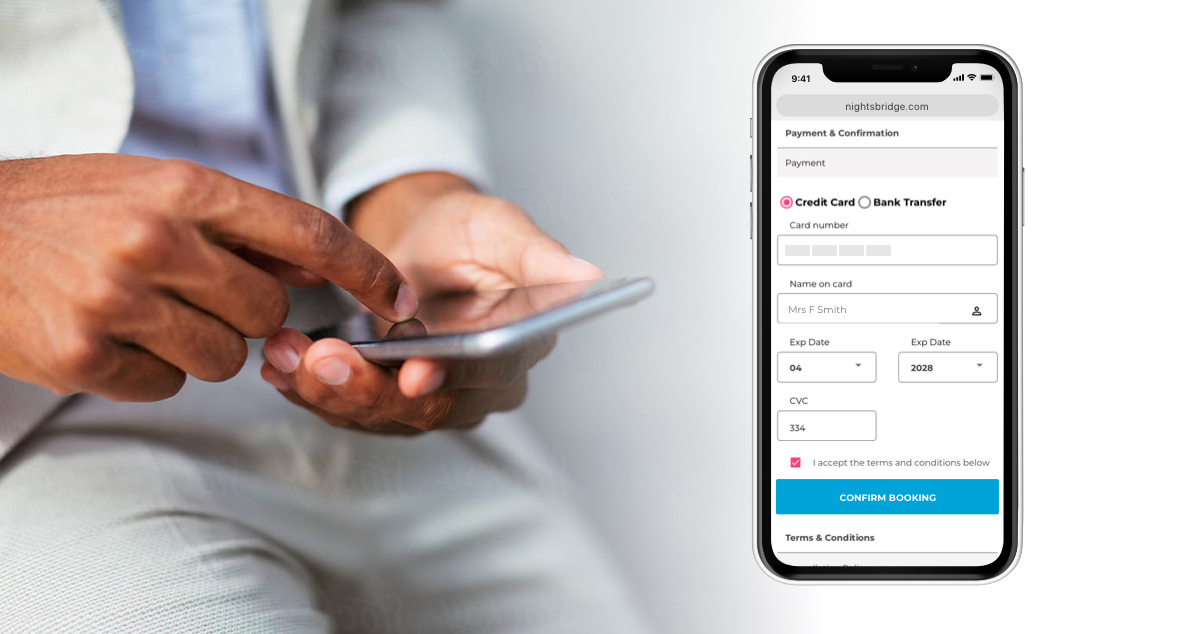

The shift towards mobile-friendly and contactless payment options was another hot topic. Theresa highlighted how the pandemic accelerated this trend, pushing businesses towards systems that allow guests to book and pay from their mobile devices or even directly from their rooms.

Why it’s important: This is all about convenience for your guests. The easier you make it for someone to book and pay, the more likely they are to do it. And in a world where everyone’s glued to their smartphones, mobile payments aren’t just nice to have—they’re essential.

The Low-down on Virtual Cards.

Virtual cards have been a game changer and were discussed at length. In the hospitality industry, booking agencies pre-load funds onto virtual cards, which are essentially online versions of debit cards. They’re becoming a staple in how online travel agencies handle transactions.

Why it’s important: Virtual cards offer a layer of security against fraud and make transactions smoother. Accommodation owners can accept the booking without worrying about whether the funds will be available in case of a no-show or cancellation.

Navigating Fees and Rates for Hospitality Payments.

Theresa didn’t shy away from the complex “layer cake” of fees involved in payment processing. She broke down how transactions incur charges at multiple levels—from banks to card networks—and stressed the importance of understanding these fees to negotiate better rates.

Why it’s important: Every penny counts in hospitality. By getting a handle on the fee structure, you can do better-informed rate shopping, ensuring you’re comparing apples with apples. This is especially crucial when dealing with international transactions, which typically have higher fees.

Streamlining Operations with Payment Tech.

Finally, Theresa talked about how integrating advanced payment technologies can streamline operations and free up time. Automating virtual card deductions on arrival dates and consolidating transactions to view inside your reservation system saves hours every week.

Why it’s important: Spending less time on administrative tasks means more time for everything else. Whether it’s improving your service, marketing your property, or just having a moment to breathe, efficient payment solutions give you that space.

READ: Big Ambitions article – How FinTech is reshaping tourism in South Africa

Theresa’s session was a goldmine for hospitality owners looking to step up their payment game. The big takeaway? Mastering modern payment technologies isn’t just about keeping up with the times—it’s about staying ahead and making the most of every booking and guest interaction.