Every property hits a money wobble at some point. You’re looking at the calendar and see a quiet patch coming, but salaries, linen, electricity and supplier bills still need to be paid. Or you’re two weeks away from season, walking through the rooms, and thinking, “If only we could refresh a few things before the crowds arrive.”

Quick tip: if you’re wondering where to start, read our guide on how to make sure your rooms are guest-ready.

That space between “we need to” and “we can afford to” is where Lula (previously Lulalend) steps in as a NightsBridge partner.

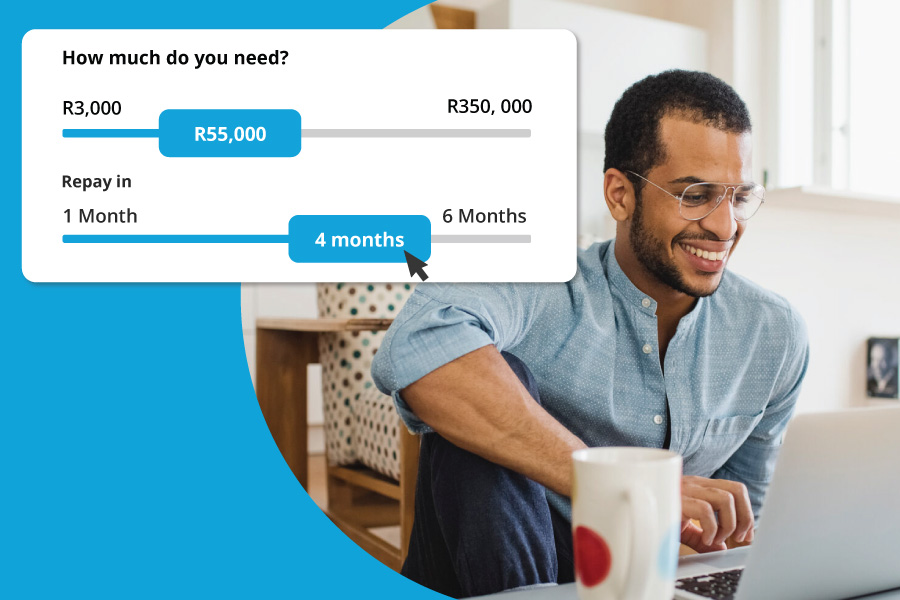

Lula is a South African digital lender that helps small and medium businesses get quick working capital. Together, we give accommodation owners a way to handle cash flow dips, act on upgrades and feel more in control of the quieter months.

What kind of funding is this?

Lula’s product for NightsBridge clients is short-term, unsecured business funding. That simply means:

- You don’t have to put up property or equipment as collateral.

- Lula looks at things like your business performance and repayment behaviour instead of your assets.

- The funding is short-term, typically repaid over a few months, and is best suited to needs that will pay back in the near future, not long, slow projects.

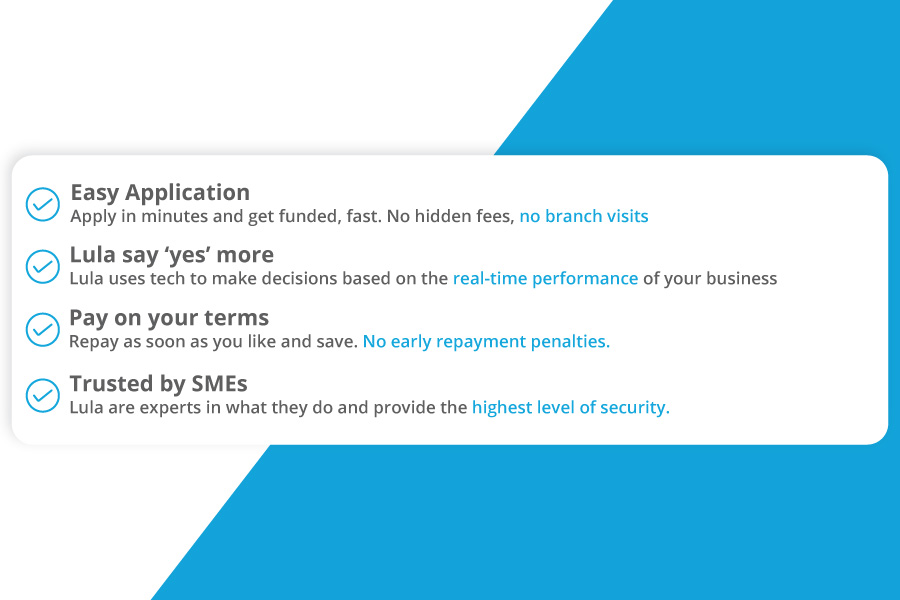

This is different from a traditional bank loan where you often need to secure the funding against a property or other assets, and where the approval process can be slower and more paperwork-heavy.

Because the funding isn’t tied to an asset, it’s sometimes called unsecured funding. That doesn’t mean reckless lending. Responsible unsecured funders like Lula still assess whether the amount fits your business’s health and cash flow.

A helpful way to think about it is the total cost of capital, not only the interest rate. A bank loan might look cheaper on rate, but can be slow, need collateral and come with stricter conditions. Bridging finance costs more, but you’re paying for speed, flexibility and no collateral.

Why cash flow hits accommodation providers so hard.

Hospitality money doesn’t move in a straight line.

You feel the seasons. Summer, school holidays and big events fill the rooms. Then winter arrives and everything slows down. The tricky part is that your costs stay almost the same through all of it.

You still pay salaries, utilities and Wi-Fi, cleaning, laundry, amenities, insurance, levies and licences. None of those take a break when bookings slow down.

On top of that, your property constantly asks for attention. Paint starts to look tired. Mattresses need replacing. A storm sends water through the roof. A geyser bursts on a long weekend. You can’t simply tell guests, “We’re not fixing this until cash flow looks better.”

Then there are the upgrades you know will pay off. Better photos for your website. A more business-friendly room layout. A small website refresh to attract the kind of guests you actually want. All of those changes help bookings and reviews, but the bill arrives before the extra revenue does.

So you sit with a simple problem. The ideas are right. The timing of the money isn’t. Bridging finance gives you a way to cover that gap for a while, so your property doesn’t have to stand still.

Put simply, cash flow is the money moving in and out of your business over a period. When more money comes in than goes out, you have breathing space. When more goes out than comes in, often in off-season, even a busy, successful property can feel under pressure. That’s exactly where the right kind of short-term funding can help.

Who is Lula?

Lula is a South African fintech company that focuses on providing business funding and cash flow tools for small and medium businesses.

They’ve built an online system so you can apply digitally, see clear costs and get to a decision quickly, often within 24–48 hours once you’ve shared all the required information.

They work with businesses that are already trading, but need a short-term cash flow boost to move forward. That fits many accommodation properties perfectly. You’re running a real business. You see the bookings, the enquiries and the potential. You just need some extra fuel to get through a gap or to upgrade at the right time.

We like that Lula speaks the language of owners and managers, not only big corporates. They get that most of our clients are on the property floor, meeting guests, handling bookings and fixing problems. No one wants to spend hours in a bank branch on top of that.

Compared to traditional banks that often want collateral and long application processes, Lula’s unsecured model is built for speed, flexibility and practicality for small and medium enterprises.

Why NightsBridge chose Lula as a partner.

We don’t partner with every financial provider that knocks on the door. When we recommend someone to our clients, our own reputation goes with it.

We look for partners who:

- Understand small and medium accommodation businesses.

- Respect the realities of seasonality and uneven cash flow.

- Offer transparent products that are practical.

Lula fits that picture. We’ve seen Lula’s bridging finance help NightsBridge clients get through low season, invest in improvements and handle surprises without derailing their guest experience.

When you stand stronger, your staff, suppliers, community and guests all feel it. If you win, we win. We’re genuinely on the same side here.

Want to explore Lula further?

If you’re curious about how bridging finance could support your property, visit Lula and read more about their options. Take a moment to think about where a short-term cash flow boost would genuinely move your business forward, whether that’s through upgrades, maintenance, stock or marketing.

It’s always a good idea to loop in a financial professional to help you see how bridging finance fits into your longer-term plans and to check your SARS compliance before you apply. See our tips on these processes in this blog post.

At NightsBridge, we keep looking for partners who make your life easier and your business stronger. Lula’s one of those, and we’re happy to have them in your corner.

In the next post, we’ll unpack practical ways to use Lula’s bridging finance in your property, from upgrades to festive stock and photography.