In our previous posts, we introduced Lula and explored the practical ways NightsBridge properties use bridging finance. Now, let’s get into the detail: how much it really costs, what funders look for, and when this type of funding genuinely makes sense for your property.

Cost of capital vs interest: how to think about the price.

When you compare funding options, it’s tempting to look only at the interest rate and compare it to a bank loan. With short-term, unsecured funding, it’s more useful to think about the total cost of capital instead.

- Interest is usually a percentage charged on the money borrowed over time, often linked to the prime lending rate.

- Cost of capital is the full cost of borrowing for the period you use the money, and takes into account that the lender is taking more risk by lending without collateral and making decisions quickly based on your trading data.

Unsecured business funding will often look more expensive than a secured bank loan if you only compare interest rates. In exchange, you get:

- Faster decisions.

- No need to tie up your property as security.

- Flexible, cash flow–linked repayments.

- The ability to settle early without penalties, meaning you only pay for the period you actually use the funds.

The key question to ask is:

“Does this total cost make sense compared to the return or protection it gives my business?”

If a burst geyser would cost you three weeks of lost bookings, or a website upgrade could bring in more high‑value guests, the comparison shifts from “rate vs rate” to “cost vs risk or opportunity.”

What owners value in a good bridging finance partner.

From our mailers, support chats and training sessions, we see the same themes come up when owners talk about short‑term funding that actually works for them.

They tend to look for:

- Speed without drama.

Approvals in days, not months. No long forms or standing in a branch. - No surprise fees.

Clear pricing upfront, with no “gotchas” buried in the small print. - The option to settle early.

If cash flow improves, they want to pay off the funding and save, not be punished with heavy penalties. - Offers based on real trading data.

Amounts that reflect what the business can realistically handle, not just marketing numbers on a website.

That’s a big part of why we partner with Lula. Their model ticks those boxes for many NightsBridge clients, but the principles above are useful no matter who you’re comparing.

Checking offers before you commit

A useful feature with modern digital funders (including Lula) is the ability to see an offer before you decide.

You can usually:

- Go through a simple online process.

- See how much you might qualify for.

- Get a sense of what the repayment structure could look like.

You don’t have to guess or phone around to get basic numbers. You can look at the offer, compare it to your forecast and decide if it feels comfortable for your business.

The important part?

You’re not forced to accept anything. A good funder lets you see the numbers, think about them and only continue if it fits your plan.

Why fixed, clear costs help in a noisy world.

We don’t have to tell you how often costs move in hospitality. Food, cleaning products, linen, maintenance, power – all creeping up.

One practical advantage of many short‑term, unsecured products is:

- Fees are set upfront.

- They don’t move every time interest rates change.

- You see the total rand figure you’ll pay over the term.

Because these products are unsecured and short term, the headline rate might look higher than a bank loan on paper. But the structure is usually simple: you see the cost, you know how repayments work, and in some models you can settle early without penalties if things go better than expected.

For a lot of owners, that level of certainty is worth something by itself.

How repayments can work in hospitality.

Hospitality money goes up and down. A rigid, fixed instalment that ignores seasonality can add stress instead of easing it.

Some funders, like Lula for NightsBridge clients, link repayments to your booking activity. An agreed percentage of your online booking payments goes towards settling your funding. You pay more back in busy times and less in quiet ones.

Even if you’re not using that exact model, it’s a good lens to use when you compare offers:

- Do the repayments line up with how my business actually earns?

- What happens in a quiet month?

- Do I still sleep at night if occupancy drops for a bit?

Before you apply: check your SARS compliance.

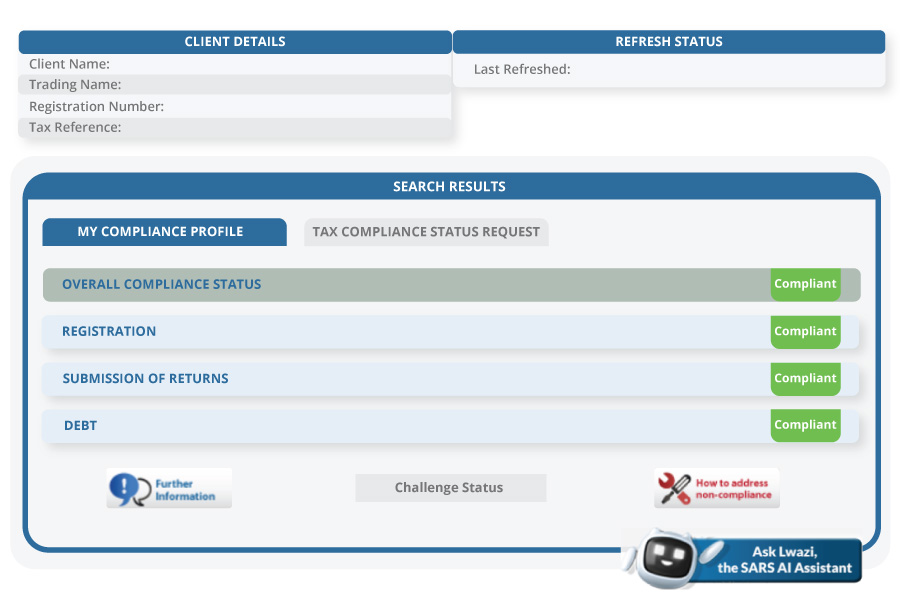

One thing many business owners overlook is SARS compliance. Funders don’t only look at your turnover and bank statements. They also look at your tax standing as a sign of financial health.

Being SARS compliant simply means you’re up to date with your main tax obligations, such as:

- Income tax.

- VAT, if you’re registered.

- PAYE for your staff.

If you’ve fallen behind, interest and penalties can snowball and put extra pressure on your cash flow. It can also make funders nervous, because:

- Tax debt adds to your financial load.

- Ongoing non‑compliance comes with legal risks.

- It can signal that you may struggle with other repayments too.

When reviewing applications, funders may look at:

- SARS payments on your bank statements.

- A Tax Clearance Certificate for larger funding requests.

- Any payment arrangements you’ve made to catch up.

If you owe SARS, it’s not always an automatic “no”, especially if the amount is small relative to your affordability and you already have a payment plan in place. But in general, being compliant – or having a clear, active plan to get there – makes it much easier to access funding.

If you’re unsure about your status, check with your accountant or on eFiling before you apply.

When does bridging finance actually make sense?

Bridging finance isn’t the answer for every situation, and that’s healthy.

It tends to work best when you plan ahead, not just when something breaks. It starts to make sense when you:

- See a quieter patch coming and want to protect your staff and service.

- Have a clear upgrade in mind that should lead to better reviews, higher rates or more bookings.

- Face urgent repairs you can’t delay without disappointing guests.

- Want to secure stock or supplier discounts ahead of season while prices are still lower.

- Prefer funding where you understand the total cost from the start and repayments connect to how your business earns.

- Are planning ahead of high season and want to use funding strategically rather than waiting until you’re already under pressure.

The key is to be honest about why you need the funding and how you expect to repay it from future bookings. Bridging finance should support a plan, not cover a hole without a next step. If the numbers only work by hoping for a miracle season, it’s safer to pause and rethink before you apply.

We always suggest that you look at the total cost and duration of any bridging finance offer, compare that to your forecasted occupancy and expenses, and speak to your accountant or financial adviser if you’re unsure, especially around SARS and tax planning.

You know your property, your guests and your risk comfort. A partner like Lula simply gives you one more way to bridge the timing gap when money and goals are out of sync.

Your next step: check the numbers, not the logo.

Before you apply for any bridging finance, take an honest look at your forecast, costs and SARS position. Ask yourself:

- What exactly will I use the funds for?

- How will it pay back – more bookings, higher rates, avoided losses?

- Do the numbers still work if next season’s numbers are a bit lower than I’d like?

Once you’re comfortable with those answers, you can look at funders that fit your business and compare offers with a clear head.

Loop in your accountant or financial advisor before you sign anything, especially around SARS and tax planning. They’ll help you see how short-term funding fits into your bigger picture and whether the timing’s right.

At NightsBridge, we’re all about tools and partners that help you run a stronger, more resilient property. Funding’s one of those tools – just not the whole plan.